When Are Interest Rates Going Up Again

Mortgage rate forecast for next week (March 21-25 )

After falling for two directly weeks, mortgage rates shot back up.

The average 30–year fixed interest rate jumped from three.76 on March 3 to iii.85% on March 10.

Involvement rates have been in a contempo state of flux – fifty-fifty more then than usual – with the Russian invasion of Ukraine creating uncertainty in global fiscal markets. Meanwhile, many economic indicators signal to growth in U.Southward. mortgage rates throughout 2022.

This week's Federal Reserve coming together should requite us a clearer motion-picture show every bit to where rates will likely go in the near–term.

In this article (Skip to...)

- Will rates go down in March?

- ninety–twenty-four hour period forecast

- Expert rate predictions

- Mortgage charge per unit trends

- Rates past loan type

- Mortgage strategies for March

- Mortgage rates FAQ

>Related: Cash–out refinance: All-time uses for your home equity

Will mortgage rates get downward in March?

Mortgage rates have been on a rollercoaster after surging throughout January and Feb.

Russia'south war on Ukraine acquired global uncertainty and subsequent interest rate drops. The longer the crunch goes on, the higher the likelihood nosotros come across more declines.

Notwithstanding, the Fed is still expected to tighten its monetary policies to keep up with aggrandizement and economical expansion, which would put upward pressure level on mortgage rates.

A scattering of industry experts gave united states of america their thoughts on where rates could go over the month and why.

"Get prepared and refinance at present equally rates are going up in 2022 and 2023."

—KC Conway, economics counselor, eXp Commercial Realty

KC Conway, economic science counselor to eXp Commercial Realty

Prediction: Rates volition ascent

"Inflation is systemic. This vii.v% and rising inflation volition strength the Federal Reserve to motion involvement rates upward aggressively in 2022 – and history tells us that once they start, they tend to move upwardly at to the lowest degree eight times and a full of 250 to 500 basis points. That means become gear up for a three%–v% 10–Year Treasury past the end of 2023.

Unfortunately, the Federal Reserve is never good at 'soft–landings' and is most always behind the curve. Get prepared and refinance now as rates are going up in 2022 and 2023 the residuum sail cutback and higher interest rates medicine for inflation by the Federal Reserve are also inflationary – and typically result in a Recession."

Nadia Evangelou , senior economist and manager of forecasting at National Association of Realtors

Prediction: Rates will rising

"I expect the thirty–year fixed mortgage charge per unit to hover around three.9% in March. Chop-chop rising inflation and expectations that the Fed will enhance short–term interest rates every bit presently as next month will go along to push up mortgage rates. March is besides the month when the asset purchase program is ready to end. That means the electric current economic stimulus policies volition cease very soon.

Considering the Fed volition heighten short–term interest rates next calendar month, I await this increase in mortgage rates caused by the Fed'southward strategy to mitigate somewhen by lower inflation in the following months.

Tensions betwixt Russia and Ukraine might affect global markets. This could continue mortgage rates low every bit more than investors would movement from stocks into the safety of bonds. Thus, I expect the 30–yr fixed mortgage rate to continue to rise but we won't likely see the big jumps that occurred over the past few weeks."

Odeta Kushi , deputy principal economist at First American

Prediction: Rates will rise

"The average xxx–year, fixed mortgage rate has increased nearly 40 basis points since the commencement of February, and expectations are that rates volition keep to rise steadily. Mortgage rates typically follow the same path as long–term bail yields, which are expected to increase due to higher inflation expectations, an improving economy, and Fed tightening.

Global events and incertitude may come into play which may put downward pressure on rates. The current Russia–Ukraine crunch clearly impacts geopolitical relations, but besides impacts the U.S. economic system, and the housing marketplace more specifically. When global investors sense increased uncertainty, there is a 'flight to safety' in U.S. Treasury bonds, which causes their toll to go upwards and their yield to go down.

While mortgage rates may bounce around week–to–week, the expectation is that rates volition inch upwards in the months to come due to these underlying factors."

Taylor Marr , deputy main economist at Redfin

Prediction: Rates will rising

"Redfin's current outlook for mortgage interest rates in March is for a small–but–steady increase in rates paired with uncertainty and volatility. There are two major opposing forces impacting mortgage rates as nosotros caput into March.

The kickoff is the geopolitical surround surrounding the tensions between Ukraine and Russia, which is simply fueling dubiousness, and thus, a flight to safety amid investors. That increased need for treasuries raises prices and lowers yields, which puts downward pressure on mortgage interest rates.

The second force is the actions of the Fed. The Fed will almost certainly begin raising short–term interest rates equally information technology wraps upward its tapering purchases of mortgage–backed securities (MBS) in March. This pulling back of demand for MBS will continue to put upward pressure on mortgage rates."

"I await there to exist minimal impact on short–run demand for homebuying, since nearly homebuying decisions are less about the lesser line and more nearly personal circumstances."

—Ralph McLaughlin, chief economist, Kukun

Ralph McLaughlin , chief economist at Kukun

Prediction: Rates volition rise

"Expect mortgage rates to proceed to rise over the month, with aggrandizement, job growth, and continued economic recovery all helping to push upwardly rates to levels non seen since earlier the pandemic.

Despite the upward tendency, I expect there to be minimal bear on on short–run need for homebuying, since most homebuying decisions are less almost the bottom line and more about personal circumstances.

The most noticeable impact of rising rates are probable to exist on rate–and–term refinancing followed past greenbacks–out. Counterintuitively, it'southward possible we could see a temporary increase in both buy and refi demand every bit households rush to lock–in low–ish rates earlier they rise whatever farther."

Rick Sharga , executive vice president at RealtyTrac

Prediction: Rates will rise

"It'southward likely that mortgage rates volition continue to ascent in March. An inflation rate of 7.5%, representing the largest 12–month increase in 40 years, and yields approaching 2% on 10–year U.S. Treasuries both advise that mortgage rates will probably border up at to the lowest degree a scrap more over the next thirty days.

In that location'southward also the question of whether or not the market has fully baked in the impact of the actions planned by the Federal Reserve. So there'south a possibility that rates may fasten when we meet the first hike to the Fed Funds charge per unit, or when the Fed actively starts unwinding its position in the bond market place."

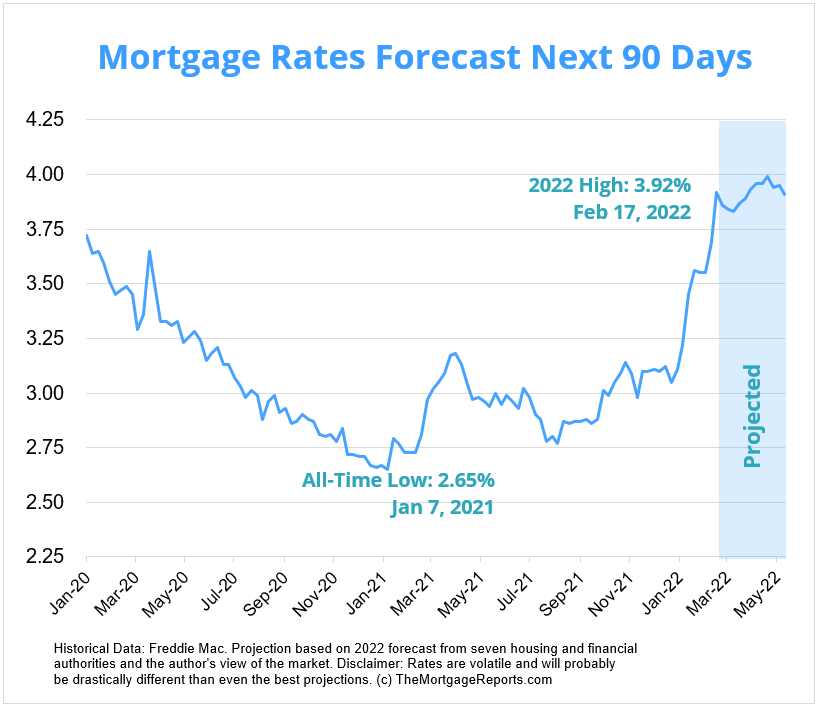

Mortgage interest rates forecast next 90 days

Aside from the Ukrainian conflict casting uncertainty into global markets, all other major indicators point to mortgage rate growth.

The almost likely outcome will exist average interest rates on an overall uptrend in the next 3 months. Of course, they have high variability and rarely get in a straight line from week to week so we could even see some drops mixed in besides.

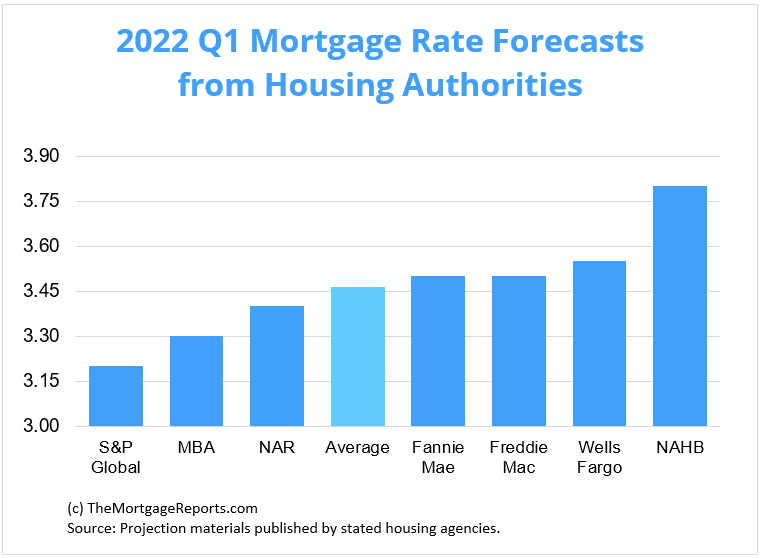

Mortgage rate predictions for 2022

The average 30–twelvemonth fixed–rate mortgage ended 2021 at 3.x%, according to Freddie Mac.

All seven of the major housing regime we gathered project that boilerplate to rise over the first quarter of 2022.

S&P Global and the Mortgage Bankers Association sit at the low finish of the group, estimating the average 30–year fixed interest rate to settle at three.20% and iii.30% by the stop of Q1. Wells Fargo and the National Clan of Habitation Builders had the highest predictions, with forecasts of 3.55% and 3.80%, respectively, past the end of March.

| Housing Authority | thirty-Yr Mortgage Rate Forecast (Q1 2022) |

| S&P Global | three.20% |

| Mortgage Bankers Clan | 3.30% |

| National Association of Realtors | 3.forty% |

| Fannie Mae | 3.l% |

| Freddie Mac | 3.50% |

| Wells Fargo | 3.55% |

| National Association of Domicile Builders | 3.80% |

| Average Prediction | 3.46% |

Current mortgage interest rate trends

Mortgage rates saw huge growth to begin 2022 and shot upwards to three–year highs. And so, the invasion of Ukraine destabilized global markets and brought rates down for 2 straight weeks.

They reversed course once again and the average 30–year fixed–rate jumped from three.76% to 3.85% for the seven days catastrophe March 10, according to Freddie Mac'south weekly rate survey.

Similarly, the 15–year fixed rate rose from three.01% to three.09%, and the boilerplate rate for a v/1 ARM increased from ii.91% to two.97%.

| Calendar month | Average 30-Twelvemonth Fixed Charge per unit |

| February 2021 | ii.81% |

| March 2021 | 3.08% |

| April 2021 | three.06% |

| May 2021 | 2.96% |

| June 2021 | 2.98% |

| July 2021 | ii.87% |

| August 2021 | 2.84% |

| September 2021 | ii.90% |

| October 2021 | 3.07% |

| Nov 2021 | 3.07% |

| Dec 2021 | iii.10% |

| Jan 2022 | 3.45% |

Source: Freddie Mac

Mortgage rates are moving away from the record–low territory seen in 2020 and 2021.

Simply continue in heed that rates are still ultra–low from a historical perspective.

But three years agone, in March 2019, thirty–yr rates averaged 4.27% according to Freddie Mac's survey. And in March 2020 they hovered around iii.45%.

So if you oasis't locked a charge per unit yet, don't lose besides much sleep over it. You tin can still get a nifty deal – specially for borrowers with strong credit.

Just brand certain yous shop around to notice the best lender and lowest rate for your unique situation.

Mortgage rate trends past loan type

Many mortgage shoppers don't realize in that location are different types of rates in today's mortgage market place.

But this knowledge tin aid dwelling house buyers and refinancing households detect the best value for their situation.

Following are 3–month mortgage rate trends for the nigh pop types of home loans: conventional, FHA, VA, and jumbo.

| Jan 2022 | December 2021 | November 2021 | |

| Conforming Loan Rates | 3.77% | 3.35% | 3.27% |

| FHA Loan Rates | 3.86% | 3.45% | 3.38% |

| VA Loan Rates | 3.56% | 3.02% | 2.96% |

| Colossal Loan Rates | iii.45% | 3.23% | three.24% |

Source: Black Knight Originations Market place Monitor Report

Which mortgage loan is best?

The all-time mortgage for you depends on your fiscal situation and your goals.

For instance, if you want to purchase a high–priced home and you have swell credit, a jumbo loan is your best bet. Jumbo mortgages let loan amounts above befitting loan limits – which max out at $647,200 in well-nigh parts of the U.South.

On the other hand, if y'all're a veteran or service fellow member, a VA loan is almost always the right choice.

VA loans are backed by the U.S. Section of Veterans Affairs. They provide ultra–low rates and never charge individual mortgage insurance (PMI). Just you demand an eligible service history to qualify.

Conforming loans and FHA loans (those backed by the Federal Housing Administration) are bully low–downwardly–payment options.

Befitting loans let as fiddling as three% downwards with FICO scores starting at 620.

FHA loans are fifty-fifty more lenient well-nigh credit; abode buyers tin can often qualify with a score of 580 or higher, and a less–than–perfect credit history might not disqualify you.

Finally, consider a USDA loan if you lot want to purchase or refinance existent estate in a rural area. USDA loans take below–market rates – like to VA – and reduced mortgage insurance costs. The catch? You lot need to live in a 'rural' area and have moderate or low income to be USDA–eligible.

Mortgage rate strategies for March 2022

Mortgage rates rose through the start of 2022 – a trend that should continue in March and the residuum of the year. Opportunities to lock in a low interest charge per unit practise still exist for home buyers and refinancing homeowners.

Hither are merely a few strategies to keep in listen if y'all're mortgage shopping in the next few months.

Waiting for a rate could be costly

Mortgage rates are notorious for their volatile nature. Fifty-fifty when it seems obvious what rates should do, they can surprise us.

Because of this, trying to time the market can frequently be a fool'due south errand.

Rates may never approach the all–time lows we saw in 2021 but they're nevertheless low from a historical standpoint. We'll likely run across ebbs and flows in March but current indicators bespeak to overall growth for the month.

Since not fifty-fifty the expert economists have a crystal brawl, the best time to lock in a mortgage is usually when you can afford to. Then go your ducks in a row and exist prepared for when the time is right for you.

Don't just stare, compare

The best way to whittle downward your interest rate is to have multiple lenders vying for your business organisation.

The ascent–rate environment we've seen will subtract the amount of refinancing in 2022 and lead to lighter pipelines for lenders. Once you lot get a qualified or prequalified charge per unit from a lender, bring that to other mortgage companies and see what they will offer you.

Making lenders compete can help y'all get a improve rate and cease upward saving you money over fourth dimension.

How to compare interest rates

Charge per unit shopping doesn't simply mean looking at the lowest rates advertised online considering those aren't available to everyone. Typically, those are offered to borrowers with perfect credit and who tin can put a downward payment of 20% or more.

The rate lenders actually offer depends on:

- Your credit score and credit history

- Your personal finances

- Your down payment (if buying a abode)

- Your domicile equity (if refinancing)

- Your loan–to–value ratio (LTV)

- Your debt–to–income ratio (DTI)

To effigy out what rate a lender can offer you lot based on those factors, you take to fill out a loan awarding. Lenders will check your credit and verify your income and debts, and then give yous a 'real' rate quote based on your fiscal state of affairs.

You should become 3–5 of these quotes at a minimum. Then compare them to detect the all-time offer.

Await for the everyman rate, but as well pay attending to your annual percentage rate (Apr), estimated closing costs, and 'discount points' – extra fees charged upfront to lower your rate.

This might sound like a lot of work. But y'all can shop for mortgage rates in nether a solar day if you put your mind to information technology. And shaving just a few ground points off your rate can salvage you lot thousands.

Mortgage interest rate FAQ

What are current mortgage rates?

Current mortgage rates are averaging 3.85% for a 30–year fixed–charge per unit loan, iii.09% for a 15–twelvemonth stock-still–rate loan, and 2.97% for a 5/1 adjustable–charge per unit mortgage, according to Freddie Mac's latest weekly rate survey. Your private rate could exist college or lower than the boilerplate depending on your credit score, downwardly payment, and the lender yous cull to work with, among other factors.

Will mortgage rates become down adjacent calendar week?

Mortgage rates could subtract next week (March 21–25, 2022) depending on how the state of affairs in the Ukraine continues to cast uncertainty on the U.S. and global economies. Though rates could rise if stiff consumer spending and aggrandizement continue and the Federal Reserve hikes its rates.

Will mortgage interest rates get downwardly in 2022?

It's unlikely mortgage rates will go down in 2022. Aggrandizement has been climbing at a tape rate over the terminal few months. And the Fed is planning to wind downward its mortgage stimulus and enhance involvement rates sooner than initially expected. Both these factors should atomic number 82 to significantly higher mortgage rates in 2022.

Will mortgage involvement rates become upward in 2022?

Yes, information technology's very likely mortgage rates will increase in 2022. High inflation, a strong housing marketplace, and policy changes by the Federal Reserve should all push rates higher in 2022. The only thing likely to push rates downwards would exist a major resurgence in serious Covid cases and further economic shutdowns. But, while it could help mortgage rates, no one is hoping for that outcome.

What is the lowest mortgage rate right at present?

Freddie Mac is now citing boilerplate 30–year rates in the mid–to–loftier–3 percent range. But remember that rates vary a lot by borrower. Those with perfect credit and large down payments may get below–average involvement rates, while poor–credit borrowers and those with non–QM loans could encounter much higher rates. You'll need to get pre–canonical for a mortgage to know your exact rate.

Will there be a housing crash in 2022?

For the most part, industry experts do not expect the housing market to crash in 2022. Yes, home prices are over–inflated. Simply many of the risk factors that led to the 2008 crash are not present in today's market. Low inventory and massive buyer need should go on the marketplace propped up next twelvemonth. Plus, mortgage lending practices are much safer than they used to be. That ways there's not a subprime mortgage crunch waiting in the wings.

What is the lowest mortgage rate ever?

At the fourth dimension of this writing, the lowest 30–year mortgage charge per unit ever was two.65 percent. That's according to Freddie Mac's Primary Mortgage Market Survey, the almost widely–used benchmark for electric current mortgage interest rates.

Should I lock my rate now or look?

Locking your rate is a personal decision. Yous should do what's right for your state of affairs rather than trying to fourth dimension the market. If yous're ownership a home, the right time to lock a rate is after you've secured a purchase agreement and shopped for your best mortgage deal. If you lot're refinancing, y'all should make sure you compare offers from at least iii to v lenders before locking a charge per unit. That said, rates are rising. So the sooner you can lock in today'southward market place, the better.

Is now a good fourth dimension to refinance?

That depends on your situation. It's a good time to refinance if your current mortgage rate is higher up market rates and you lot could lower your monthly mortgage payment. Information technology might likewise be good to refinance if you tin can switch from an adjustable–rate mortgage to a low fixed–rate mortgage; refinance to get rid of FHA mortgage insurance; or switch to a short–term 10– or 15–yr mortgage to pay off your loan early.

Is it worth refinancing for one per centum?

It's often worth refinancing for i per centum point, as this can yield significant savings on your mortgage payments and total interest payments. Just make sure your refinance savings justify your endmost costs. You can use a mortgage calculator or speak with a loan officer to crunch the numbers.

How practise I shop for mortgage rates?

Start by choosing a list of iii–5 mortgage lenders that yous're interested in. Await for lenders with low advertised rates, great customer service scores, and recommendations from friends, family, or a existent estate amanuensis. Then get pre–canonical by those lenders to encounter what rates and fees they tin can offering you. Compare your offers (Loan Estimates) to find the all-time overall bargain for the loan type you want.

What are today'south mortgage rates?

Low mortgage rates are all the same available. Connect with a mortgage lender to find out exactly what rate you qualify for.

1Today's mortgage rates are based on a daily survey of select lending partners of The Mortgage Reports. Interest rates shown here assume a credit score of 740. See our total loan assumptions here.

Selected sources:

- https://www.blackknightinc.com/category/printing–releases

- https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

- http://world wide web.freddiemac.com/research/datasets/refinance–stats/index.page

The information contained on The Mortgage Reports website is for informational purposes only and is not an ad for products offered by Total Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

Source: https://themortgagereports.com/32667/mortgage-rates-forecast-fha-va-usda-conventional#:~:text=%E2%80%9CInflation%20is%20systemic.,250%20to%20500%20basis%20points.

0 Response to "When Are Interest Rates Going Up Again"

Post a Comment